This article originally appeared in www.finance.yahoo.com by Andy Swan on July 21, 2018

Andy Swan is the co-founder of LikeFolio, a company that provides social data for investors. The company does this by analyzing “purchase intent mentions,” statements on social media that suggest a consumer intends to buy a particular product or recently bought it.

Drinker’s tastes and priorities are shifting in a major way. Beer, wine and mixed drinks have traditionally dominated the adult beverage industry, beer being the front-runner.

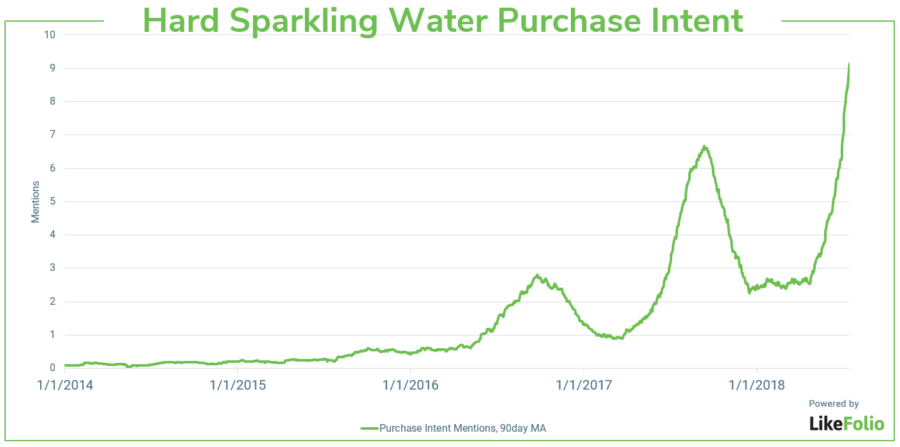

But the low-carb movement is shaking up the industry as consumers shift to healthier alternatives, especially hard sparkling water:

The chart above shows increased purchase intent mentions for consumers drinking and purchasing hard sparkling water. This surge, coupled with impressive sales numbers for hard sparkling water brands in 2018, indicates strong growth across the board.

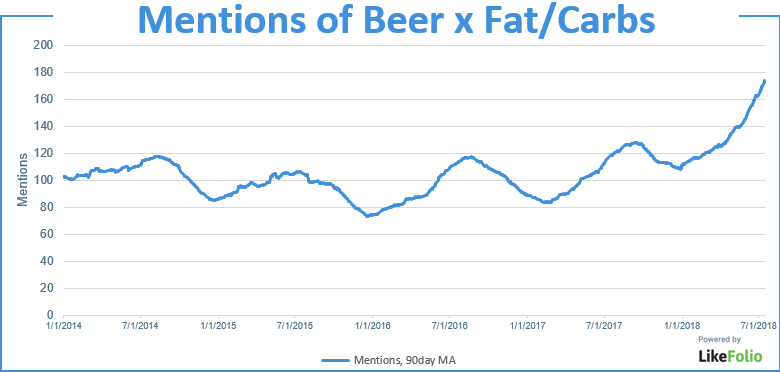

What’s driving this shift in consumer behavior?

Carbs. Health-conscious consumers are avoiding sugars more and more, especially in their drinks.

To investigate this trend towards health-conscious decision-making, we looked deeply at consumer tweets that mentioned both beer and either “fat” or “carbs”:

As you can see, the volume of tweets showing concern for beer’s nutritional value (or lack thereof) has risen dramatically, with an especially sharp increase in mentions within the exact time frame that hard seltzer mentions began to skyrocket.

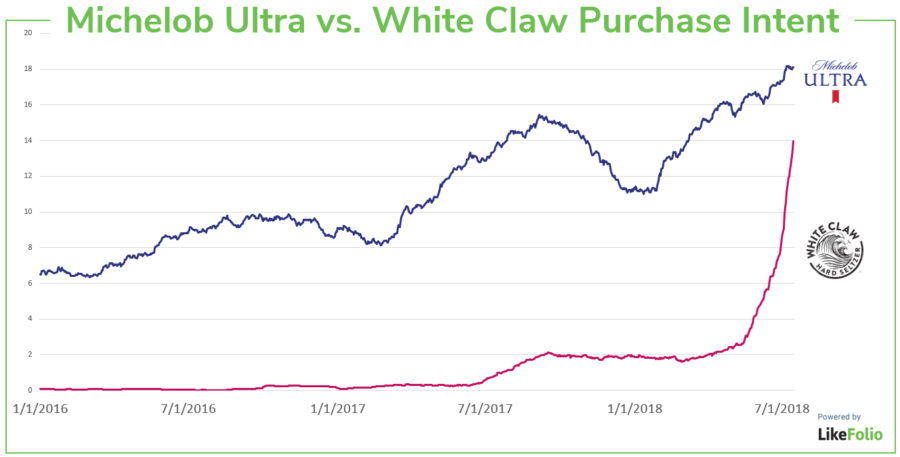

This becomes even more striking when we look at Purchase Intent for the dominant low-carb beer, Michelob Ultra, against newcomer and leader of the hard sparkling movement, White Claw:

Obviously, both brands are growing… another sign that the low carb movement is impacting alcohol sales. But it’s the dominant growth of White Claw that really stands out, and threatens legacy brewers.

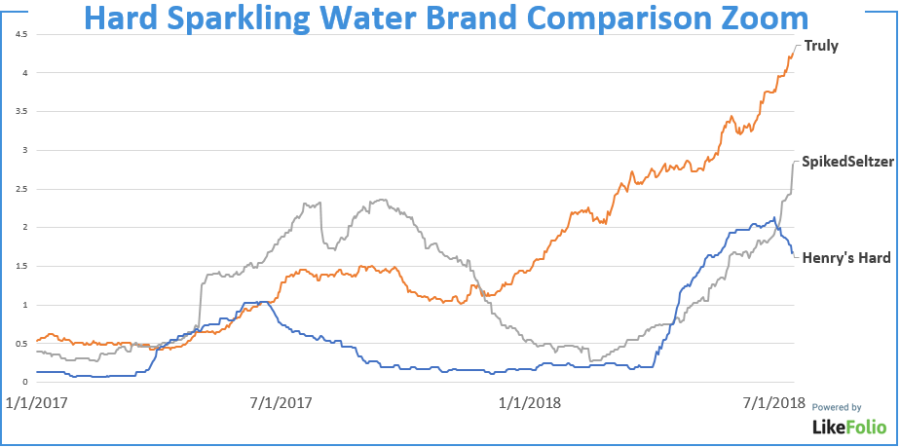

Who’s winning the hard sparkling race so far?

White Claw (Mark Anthony Brands), Truly (Boston Brewing Company: SAM), and Henry’s Hard Sparkling (Molson Coors: TAP) were all launched in 2017 as a response to Anheuser-Busch (BUD) purchasing SpikedSeltzer.

While White Claw is the early leader, here’s a look at how some of the other hard sparkling beverages are performing in terms of consumer purchase intent mentions. We can see that Truly, SpikedSeltzer, and Henry’s Hard are showing record numbers this summer even before their traditional seasonal peak … further confirmation that this trend may just be beginning!